Understanding the bright-line property rule

The bright-line property rule has been in the news a lot recently because it has been extended to 10 years. But what does this mean to property owners and does it affect you?

What is it?

Also referred to as the bright-line test, it is a rule that applies to residential property that is sold within a certain time-frame from when it is purchased.Depending on how long you’ve owned your residential property before you sell it, you may need to pay income tax on any profit made through the increased value of the property during that timeframe.

Who does it affect?

Anyone buying and selling residential property on or AFTER 1 October 2015.

It also applies to New Zealand tax residents who buy overseas residential properties.

Exclusions from the property rule

The bright-line property rule does not apply to:

- properties bought BEFORE 1 October 2015.

- the sale of your main home, inherited property, or if you’re the executor or administrator of a deceased estate – although there are different rules that apply to your main home depending if it was acquired before, or on or after, 27 March 2021. We can help guide you through this too.

- property sold outside the applicable bright-line period (but other property sale rules will still apply).

What are the rules?

The bright-line property rule looks at whether you bought your property:

- on or after 27 March 2021, and sold within the 10-year bright-line period

- between 29 March 2018 and 26 March 2021, and sold within the 5-year bright-line period

- between 1 October 2015 and 28 March 2018, and sold within the 2-year bright-line period.

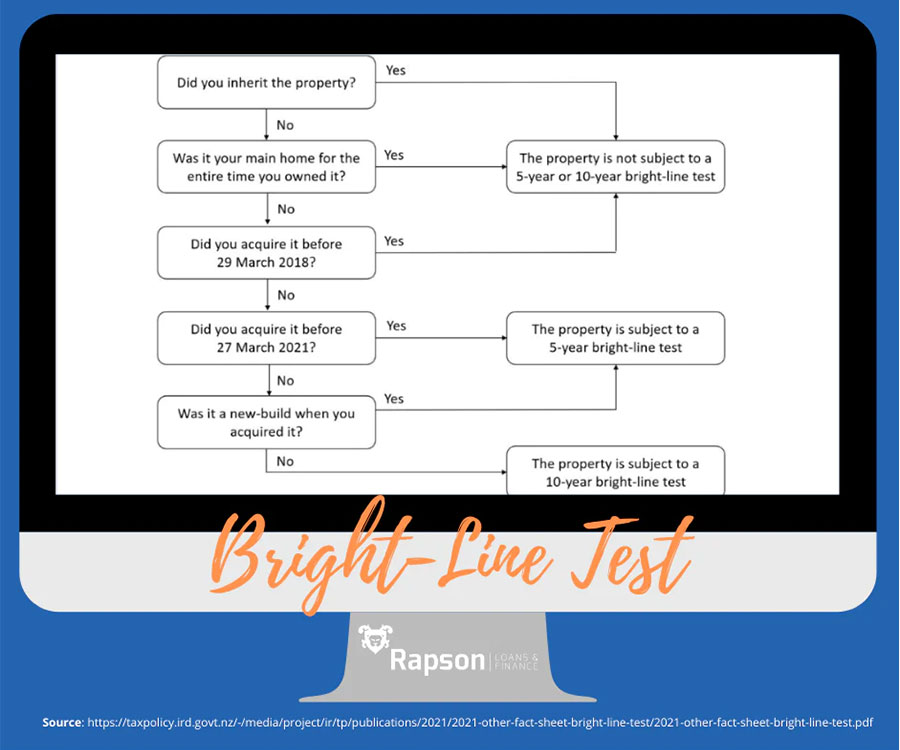

This simple graph of the bright-line test will help you work it out:

Track Record is important

While the lender wants to understand your plans for the future, looking at your track record is of equal concern to them. Financial behaviour is important. Lenders will typically look at the last 12 months of bank transactions to ascertain if you’re responsible with your money. Do you pay your bills on time, how do you service any credit cards or other loan payments, is there excess spending on non-essential items? These are just a few examples of what they may look for.

Therefore, it’s a good idea to develop sound business and financial habits early on.

More than just numbers

There’s no denying that your financial situation and cashflow are important factors for lenders to base their decision on. However, it’s not the ONLY factor. You as a person and your character and behaviours play an important role too. During the meeting and by looking at your plan, the lender needs to be re-assured they can trust you to make your repayment obligations.