Case Study: Buying First Home With Friends

There are many avenues to getting on the property ladder, and one Rapson Loans & Finance is seeing more often is first-home buyers pooling resources with their friends and family.

When it comes to buying a home, not having a partner to share the challenge of saving for a deposit and repaying a mortgage might make it feel like the odds are stacked against you. However, if you're not in a relationship, don't assume you have to navigate the journey to homeownership alone.

Rapson’s Tristan Hewett and Michelle Schwab recently helped two childhood best friends, Danu and Luke, turn their homeownership dreams into a reality. We share their story.

Danu & Luke’s Journey

Best mates since childhood, Danu and Luke were tired of the uncertainty that came with renting. Instead of jumping between rentals, they wanted the security of their own home.

They recently teamed up to purchase their first home in Tauranga; a difficult property market to enter.

Driven by a shared vision of stability and investment in their future, with a similar financial standing, the men showed the conventional route to homeownership is not the only one.

How They Did It

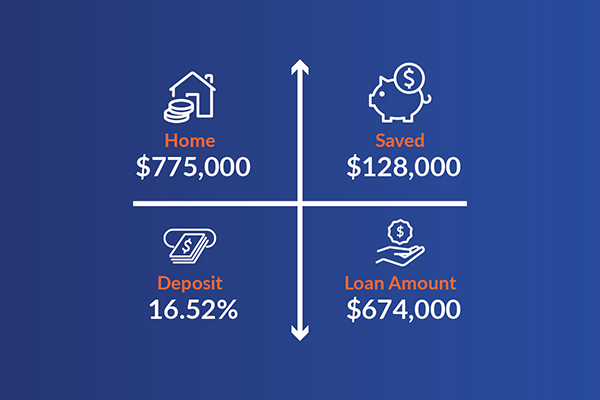

The pair managed to garner a 16.5% deposit to purchase a $775,000 home in Tauranga.

How did they reach this point?

Danu and Luke combined their personal savings and Kiwisaver, as well as gifted money. As they had been contributing to KiwiSaver long-term and were purchasing an existing property in Tauranga under $800,000, which meant they were eligible for the Kāinga Ora First Home Grant.

The pair placed an unconditional offer on a property that was passed in at auction, that would later become their slice of paradise.

Expert Advice

Danu learned of Rapson Loans & Finance through a referral from a workmate.

Rapson Financial Advisors Tristan and Michelle played a critical role in helping Danu and Luke secure their first home.

After the pair took the nerve-wracking step of placing a post-auction offer on a home, Michelle helped to ease their stress by guiding them through the process.

Tristan and Michelle helped them secure a $647,000 loan, and worked through loan structure to ensure their repayments are manageable.

“Collaborating with Danu and Luke to make their dream a reality was incredibly rewarding. We take pride in helping clients explore unconventional avenues to achieve their homeownership goals,” says Michelle.

Benefits of Co-Ownership

A significant advantage of co-owning a home is the combined strength of multiple resources.

Buying a property can be a monumental undertaking. Sharing the burden of mortgage repayments, deposit requirements, and ongoing costs, co-ownership offers a pathway for first-home buyers to access the market sooner.

Where Co-Ownership Gets Tricky

The disparity in cash rates between New Zealand and Australia reflects each country’s unique economic circumstances and central bank strategies.

While New Zealand’s proactive measures aim to curb inflation amid labour shortages, Australia’s gradual approach acknowledges different economic conditions.

As central banks navigate this challenging time, borrowers and businesses in both countries will feel the ripple effects of these monetary policy choices.

Mitigating Risks

The disparity in cash rates between New Zealand and Australia reflects each country’s unique economic circumstances and central bank strategies.

While New Zealand’s proactive measures aim to curb inflation amid labour shortages, Australia’s gradual approach acknowledges different economic conditions.

As central banks navigate this challenging time, borrowers and businesses in both countries will feel the ripple effects of these monetary policy choices.

Your Co-Ownership Journey

Danu and Luke’s journey holds valuable lessons for aspiring first home buyers.

Co-ownership with friends or family can unlock the door to homeownership faster and with more financial support.

While the benefits are substantial, it’s crucial to approach co-ownership with careful consideration. Collaborating with trusted friends, obtaining professional financial advice, and drafting thorough legal agreements can help mitigate risks.